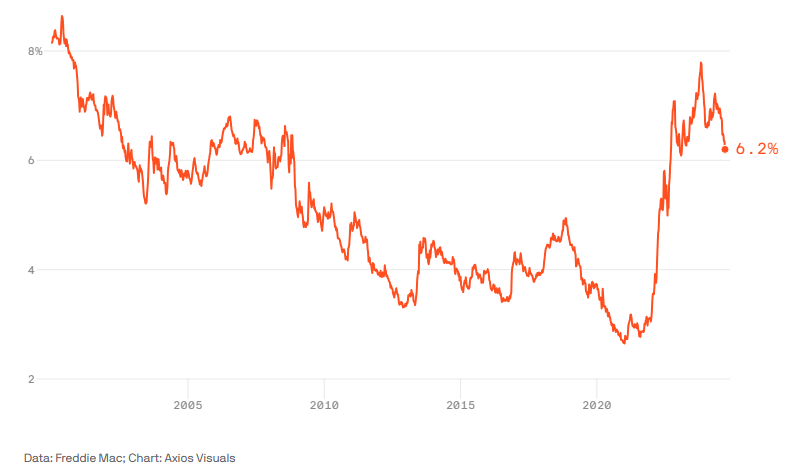

U.S. mortgage rates are at lows not seen since early 2023, ahead of next week’s expected interest rate cut.

Why it matters: Easing mortgage rates offer house-hunters some relief. But experts say it’s going to take a bigger drop to revive the sluggish home market.

The latest: A small but growing number of people are taking out new mortgages.

- Mortgage applications hit a 19-month high in August and have continued to climb the last three weeks, according to the Mortgage Bankers Association.

Reality check: Mortgage rates won’t fall much immediately after the September Federal Reserve meeting, analysts say.

- Realtor.com chief economist Danielle Hale tells Axios she isn’t expecting them to dip below 6% this year.

Yes, but: For some homebuyers, a near-6% mortgage is good enough.

- “I am OK with the rate I got knowing I can always refinance,” says Jackie Elegant, who’s purchasing a Chicago condo.

The other side: Record home prices and low inventory continue to sideline many shoppers. And homeowners remain reluctant to give up their less expensive mortgages.

- Nearly 86% of U.S. mortgage holders have a rate under 6%, per Redfin.

The bottom line: Rates are volatile. “We see sharp moves daily,” sometimes as much as 0.25% up or down, HomeSimply owner Donny Kirby tells Axios.